Money-lending is a business. Can’t believe we have to say that, but we do… and it’s the simple truth.

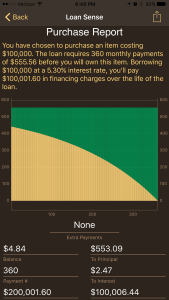

Lenders need to be repaid more money than they lent out – or else there’s no point to being in that business. The original amount of money you borrow is called the ‘principal’ and the extra money you repay is called ‘interest’. Principal and Interest are important terms which you will see everywhere. If necessary, take some time to understand and remember what they mean.

Interest is where those businesses hope to make money, but only if the amount collected in interest exceeds the amount of principal that becomes uncollectible. You are expected to completely repay the principal amount, with the added amount of interest. Making money in business is not guaranteed, sometimes a bad deal is made and the business loses money. With lending, the interest collected must make up for the money lost when borrowers stop paying and deals go bad.

Lending money is a healthy business; banks are doing just fine. Here’s an interesting fact – Financing a house using a fixed rate 30-year mortgage without additional payments … when the interest rate exceeds 5.3042% APR, the lender collects more than the price of the house through interest payments over the 30 year term.