Loan payments can be difficult to calculate.

Generally, each month you pay interest for only that month – that’s 1/12th the yearly rate (APR = Annual Percentage Rate). You also only pay interest based on the loan’s current outstanding balance.

- Loan: Balance of 100 remaining at 12% APR

- Pay the loan off in 10 months.

- This month’s interest = 12% APR / 12 months = 1% x 100 = 1 in interest.

- Balance paid per month: 100 / 10 months = 10

- This Months payment = Balance payment (10) + Interest payment (1) = 11

- Remaining balance = 100 – 10 = 90

Since the balance is less each month, the interest also decreases:

- Loan: Balance of 90 remaining at 12% APR

- Pay the loan off in 9 months.

- This month’s interest = 12% APR / 12 months = 1% x 90 = 0.9 in interest.

- Balance paid per month: 100 / 10 months = 10

- This Months payment = Balance payment (10) + Interest payment (0.9) = 10.9

- Remaining balance = 90 – 10 = 80

And the next month:

- Loan: Balance of 80 remaining at 12% APR

- Pay the loan off in 8 months.

- This month’s interest = 12% APR / 12 months = 1% x 80 = 0.8 in interest.

- Balance paid per month: 100 / 10 months = 10

- This Months payment = Balance payment (10) + Interest payment (0.8) = 10.8

- Remaining balance = 80 – 10 = 70

These would be the 10 payments: 11, 10.9, 10.8, 10.7, 10.6, 10.5, 10.4, 10.3, 10.2, 10.1. In total, those payments add up to 105.5.

The original 100 has been completely paid back, and an additional 5.5 has been paid in interest. This method works very well if you don’t mind making a different payment each month.

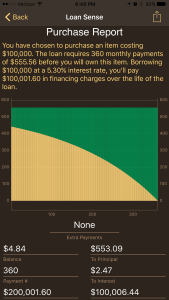

Lenders want you to make the same payment every month… with declining interest and increasing principal payments that equal the same amount each month and end up paying off all the interest with the remainder of the principal during the last identical payment. Setting up all these payments requires much more complicated math.

An amortization schedule lists the amounts which will be allocated to principal and interest within each equal payment over the life of the loan.